Call Options vs Put Options: The Difference

Contents:

Pay 20% upfront margin of the transaction value to trade in cash market segment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. For example, curd is a type of derivative as it has no value of its own. It derives its value from the value of the underlying asset i.e. milk. Warren Buffett has described derivatives as weapons of mass destruction. Options, a type of derivatives, also falls under the category of weapons of mass destruction.

However by no means I am suggesting that you need not hold until expiry, in fact I do hold options till expiry in certain cases. Generally, speaking option sellers tend to hold contracts till expiry rather than option buyers. This is because if you have written an option for Rs.8/- you will enjoy the full premium received, i.e. The buyer of a call option pays the option premium in full at the time of entering the contract. Afterward, the buyer enjoys a potential profit should the market move in his favor.

- Some brokers have specialized features and benefits for options traders.

- For a limited investment, the buyer secures unlimited profit potential with a known and strictly limited potential loss.

- Her strength lies in simplifying complex financial concepts with real life stories and analogies.

- Finding the right financial advisor that fits your needs doesn’t have to be hard.

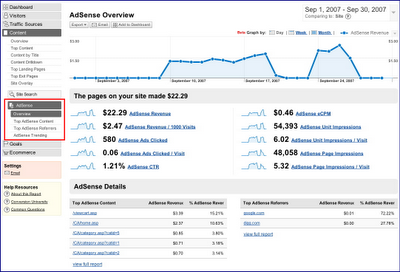

The put-call ratio can be an indicator of how the market views recent events or earnings. A ratio at either extreme suggests an overly bearish or overly bullish sentiment. A PCR above one indicates traders buying more put options , below one indicates traders purchasing more call options , and at 1 indicates a neutral market. A put option is about selling a security at a pre-specified price, and a call option is the right to purchase an asset at a prefixed price. The value of a call on a put changes in inverse proportion to the stock price.

When to buy calls and put options?

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

If you dont sell the call imeedietely when you are buying the stock futures, then u r at loss…. But u are buying futures only when u r optimistic about the stock….. In the future, in this module, we will understand each of these forces and their characteristics.

Finally, on the right, the pay off diagram of Put Option and the Put Option are stacked one below the other. Clearly, the pay off diagrams looks like the mirror image of one another. The mirror image of the payoff emphasizes the fact that the maximum loss of the put option buyer is the maximum profit of the put option seller.

Put-Call Ratio Explained

On the flip side, someone places a bet that the Facebook stock price will drop to $230 by April 2021. And if the price falls to $230 by the set expiry date, they will earn $20. Remember, the open positions for both trading activities at predetermined prices and a specified time are considered for the calculation.

Time decay accelerates as an option’s time to expiration draws closer since there’s less time to realize a profit from the trade. When an option loses its time value, the intrinsic value is left over. An option’s intrinsic value is equivalent to the difference between the strike price and the underlying stock price. If an option has intrinsic value, it is referred to as in the money .

Fortunately, the same can be done from the underlying stock at the specified strike price. Purchasing a put option is a way to hedges against the drop in the share price. So, even if the stock price declines on a put option, they can avoid further loss. The investor could also profit from a bear market or dips in the prices of the stocks. Conversely, if an investor purchases a put option, they have the right to sell a stock at a specific price up until an expiration date. The investor who bought the put option has the right to sell the stock to the writer for their agreed-upon price until the time frame ends.

This is significant because fewer calls being bought can push the ratio higher without an increased number of puts being purchased. In other words, we don’t need to see a large number of puts being purchased for the ratio to rise. The put-call ratio helps investors gauge market sentiment before the market turns. However, it’s important to look at the demand for both the numerator and the denominator .

Of course, there is an angle of volatility here which we have not discussed yet; we will discuss the same going forward. The reason why I’m talking about volatility is that volatility has an impact on option premiums. When you sell an option, you receive a premium payment from the buyer. However, you’re promising to buy or sell shares at the strike price outlined in the contract should the buyer choose to exercise their option.

Buying call options vs. buying put options

The company is concerned about the exchange risk posed by the weaker euro if it wins the project. Buying a put option on 10 million euros expiring in one year would involve a significant expense for a risk that is as yet uncertain . The judge discussed the schedule as attorneys for Carroll prepared to wrap up their case on Thursday. The judge is expected to recess the trial on Friday, as he did last week, in order to handle other court business.

JeFreda R. Brown is a financial consultant, Certified Financial Education Instructor, and researcher who has assisted thousands of clients over a more than two-decade career. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. If you expect the price of Reliance Industries to increase to Rs 2,000. If you expect the price of milk to increase, then the price of curd will also automatically increase. No single ratio can definitively indicate that the market is at its top or its bottom. Even the levels of the put-call ratio that are considered extreme are not set in stone and vary over the years.

Should I Buy In the Money (ITM) or Out of the Money (OTM) Puts?

When we do so, I’m certain you will see the calls and puts in a new light and perhaps develop a vision to trade options professionally. He paid $2,500 for the 100 shares ($25 x 100) and sells the shares for $3,500 ($35 x 100). His profit from the option is $1,000 ($3,500 – $2,500), minus the $150 premium paid for the option. Thus, his net profit, excluding transaction costs, is $850 ($1,000 – $150).

- Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security.

- However, it entirely depends on the investor’s investment objective and risk tolerance.

- Your sole source of income in this case is limited to the premium you collect on expiration of the options contract.

- Her goal is to make common retail investors financially smart and independent.

- Time decay accelerates as an option’s time to expiration draws closer since there’s less time to realize a profit from the trade.

This needs to be paid to the seller or writer of the call option contract. With a put option, you’re essentially managing the risk in your portfolio. So, let’s say you have 100 shares of Stock ABC currently worth $100 and you think the price will fall. You may purchase a put option with the right to sell at $100 a share. This means instead of losing $1,000 in the market you may only lose your premium amount.

A call buyer profits when the underlying asset increases in price. A call option seller can generate income by collecting premiums from the sale of options contracts. The tax treatment for call options varies based on the strategy and type of call options that generate profits. The payoff calculations for the seller for a call option are not very different. If you sell an ABC options contract with the same strike price and expiration date, you stand to gain only if the price declines. Depending on whether your call is covered or naked, your losses could be limited or unlimited.

The front fee is the option premium paid by an investor upon the initial purchase of a compound option. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Please note that the first component is equivalent to the difference between the strike price and the underlying price. When the underlying price gets lower in comparison to the strike price, the higher your cash gain becomes during expiration. This means the premium of a put option rises as the price of the underlying stock decreases. Alternatively, when the premium of a put option declines, the stock price rises considerably.

That way, they can “win” in some way, no matter which way the stock goes. According to the Options Clearing Corp., 2021 saw the highest options-trading volume of any year on record, and 2022 saw the second-highest volume. If you’ve been reading about finance in the past couple of years, you’ve almost certainly heard of options — and their meteoric rise in popularity. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor.

Turtle Beach (HEAR) Q1 2023 Earnings Call Transcript – The Motley Fool

Turtle Beach (HEAR) Q1 2023 Earnings Call Transcript.

Posted: Fri, 05 May 2023 03:30:30 GMT [source]

Whether options trading is right for you depends on a variety of factors. These include your level of financial security, your investment goals and your risk tolerance. If the stock rises, then they can let their put expire worthless and collect profits by selling the underlying stock, minus the premium they paid for the put. If the stock falls, then they can exercise or resell their put for a profit, which could offset the losses from owning the underlying stock.

The majority of investors purchase ‘puts’ only when they’re determined that the underlying asset’s price will decrease. Likewise, they sell puts once they know that the underlying assets will increase. An investor may want to place a call option if they anticipate the rise of a stock’s price.

Seward Electric election too close to call – kdll.org

Seward Electric election too close to call.

Posted: Thu, 04 May 2023 02:09:00 GMT [source]

That’s a very nice return on investment for just a $150 investment. Because there is no obligation to exercise an options contract, the maximum risk a buyer faces is limited to the premium they paid. LossFor a call option buyer, the loss is limited to the premium paid. Sometimes investors may sell options to incorporate them into other types of option strategies.

The initial premium is paid up front for the call option, and the additional premium is only paid if the call option is exercised and the option owner receives the put option. The premium, in this case, would generally be higher than if the option owner had only purchased the underlying put option, to begin with. So whatever profit the buyer makes is typically the loss of the seller. And if the spot price is lower than the strike price during expiry, the put option will be exercised on the seller. But if it’s vice versa, the buyer enables his option un-exercised while the seller keeps the premium amount. Also, your losses are likely to be unlimited whenever you are forced to purchase the underlying stock at spot prices.

So, an average put-call ratio of 0.7 for equities is considered a good basis for evaluating sentiment. In general, the put call ratio shows as an investor’s investment strategy. The two common strategies are Contrarian – where traders expect a turnaround when the ratio is higher and a retreat when the proportion is lower . Momentum is another default strategy to measure the put-call option.

The gain/loss profiles for the put buyer and put writer are thus diametrically opposite. Put options, as well as many other types of options, are traded through brokerages. Some brokers have specialized features and benefits for options traders. For those who have an interest in options trading, there are many brokers that specialize in options trading. It’s important to identify a broker that is a good match for your investment needs. Put options give holders of the option the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time frame.

For an call put meaning who is confident that a company’s shares will rise, buying shares indirectly through call options can be an attractive way to increase their purchasing power. What happens when ABC’s share price declines below $50 by Nov. 30? Since your options contract is a right, and not an obligation, to purchase ABC shares, you can choose to not exercise it, meaning you will not buy ABC’s shares.

Neither option buyer will exercise their contracts as long as the stock’s price remains between $45 and $55. However, if the stock moves significantly in either direction, Jane could lose money when the buyer exercises the contract. When you buy a call option, you’re buying the right to purchase shares at the strike price described in the contract.